Tax amount calculator

Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Or keep the same amount.

Ontario Income Tax Calculator Wowa Ca

Nairobi Water Bill Calculator.

. It is advised that for filing of returns the exact calculation may be made as per the provisions contained in the relevant Acts Rules etc. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. 54 rows A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Kenya PAYE Calculator with Income Tax Rates Of January 2022 Calculate KRA PAYE Net Pay NHIF and NSSF Contribution. Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase.

Heres how to calculate sales tax by hand. This converts it to the actual percentage rate of the. To change your tax withholding amount.

The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors including your income number of dependents and filing status. That entry would be 0775 for the percentage. Enter the sales tax percentage.

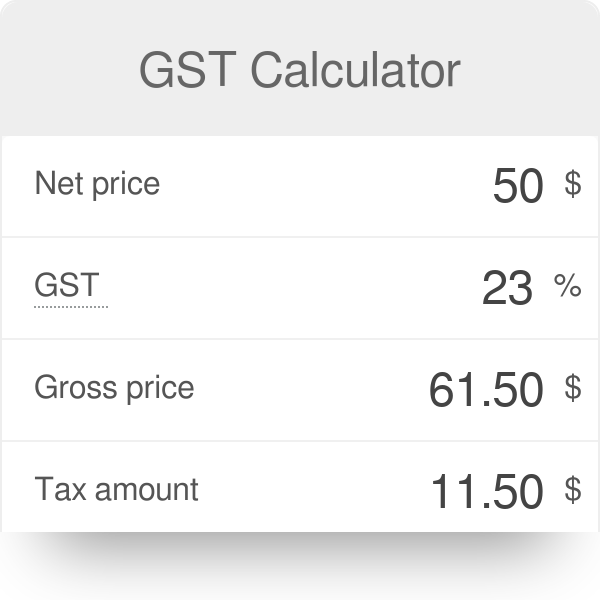

The following table provides the GST and HST provincial rates since July 1 2010. Who the supply is made to to learn about who may not pay the GSTHST. Enter the total amount that you wish to have calculated in order to determine tax on the sale.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances. Where the supply is made learn about the place of supply rules.

This income tax calculator will allow you to quickly and easily see your tax or government deductions based on your salary. We then added the dollar amount for income sales property and fuel taxes to calculate a total tax burden. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one.

Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Total price 54500 - listed price 500 45 Then divide the difference amount 45 by the listed price. Use your estimate to change your tax withholding amount on Form W-4.

Allowances Please Enter Amount. If you are looking to find out your take-home pay from your salary we recommend using our Pay As You Earn. Calculate Your 2022 Tax Return 100.

To use this income tax calculator simply fill in the relevant data within the green box and push Calculate. Finally each county was ranked and indexed on a scale of 0 to100. The sales tax added to the original purchase price produces the total cost of the purchase.

45 500 009 Finally multiply that number by 100. For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay.

The rate you will charge depends on different factors see. Sales tax is calculated by multiplying the purchase price by the sales tax rate to get the amount of sales tax due. Easily E-File to Claim Your Max Refund Guaranteed.

52-Week Savings Calculator. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Submit or give Form W-4 to your employer.

The county with the lowest tax burden received a score of 100 and the remaining counties in the study were scored based on how closely their tax burden compares. Subtract the listed item price from the total price you paid. Type of supply learn about what supplies are taxable or not.

Sales Tax Calculator. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software.

There are a variety of other ways you can lower your tax liability such as. Thats where our paycheck calculator comes in. Ask your employer if they use an automated system to submit Form W-4.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax outcome. Taking advantage of deductions. Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

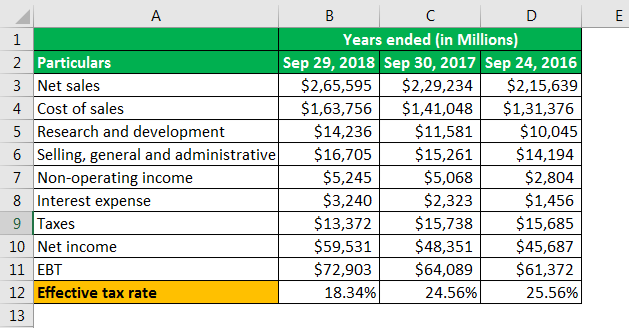

Effective Tax Rate Formula Calculator Excel Template

Annual Income Calculator

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

How To Calculate Income Tax In Excel

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Gst Calculator How To Calculate Gst

Effective Tax Rate Definition Formula How To Calculate

Effective Tax Rate Formula Calculator Excel Template

How To Calculate Income Tax In Excel

Gross To Net Calculator

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Sales Tax Calculator

Sales Tax Calculator

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Excel Formula Income Tax Bracket Calculation Exceljet